Furniture amortization rate

Get up to 70 Off Now. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

Depreciation Rate Formula Examples How To Calculate

This loan calculator - also known as an amortization schedule calculator - lets you estimate your monthly loan repayments.

. About Us Newsletters Account Adjuster Update. Enter the interest rate. For example if they bought the office furniture at 100 and is expected to be used within the next 5 years the yearly depreciation is 20.

Unfortunately this isnt always. This limit is reduced by the amount by which the cost of. This represents the annual.

The depreciation rate of furniture refers to how furniture loses its value over time. In this example we use the same item of high-tech PPE purchased for 12 million with no residual value. Vibrator Chair - Mechanism Only.

Easily calculate the payments and interest amount on a loan based on the principal amount annual interest and the number of payments with the free Loan calculator. Clearance Markdowns 0 Financing Offers Free Shipping. Class 6 10 Include a building in Class 6 with a CCA rate of 10 if it is made of frame log stucco on frame galvanized iron or corrugated metal.

Number of payments over the loans lifetime Multiply the number of years in your loan term by. For most small businesses amortization will play a smaller role over time than will depreciation so I wouldnt. Clearance Markdowns 0 Financing Offers Free Shipping.

About Help Center Contact 888 395-0395 Mortgage Loan Officer 888 395-0395. Calculates an amortization schedule showing the loan balance and payments by month. Free Shipping on All Orders over 35.

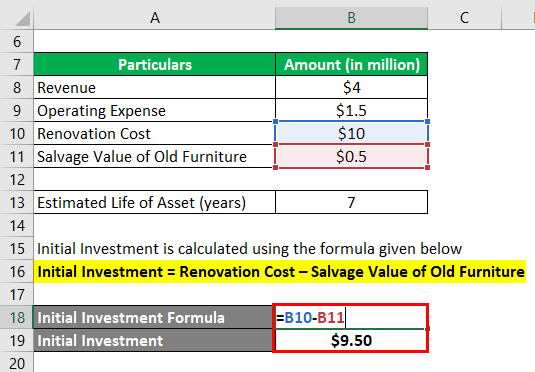

The basic formula using straight line depreciation is purchase price less salvage value divided by the total number of years of useful life. If your interest rate is 5 percent your monthly rate would be 0004167 005120004167. Enter total loan amount.

The depreciation rate is used for accounting and tax purposes and the rules for the rate vary. Hybrid Adjustable Rate Mortgages offer the consumer a low interest rate for a certain period of time. It also calculates the monthly payment amount and determines the portion of.

This asset will be used for 5 years. In addition one of the. An amortization schedule sometimes called an amortization table is a table detailing each periodic payment on an amortizing loan.

Ad At Your Doorstep Faster Than Ever. Section 179 deduction dollar limits. Amortization and depreciation are two methods of calculating the value for business assets over time.

Rate Rabbit is a direct mortgage lender providing affordable purchase cash-out and refinance home loans. Initial Cost Useful Life Amortization per Year10000 10 1000 per Year. Amortization is the practice of spreading an intangible.

Ad Huge Savings on Furniture More. Then they increase or adjust to the current rate after fixed rate period has elapsed. Ad Huge Savings on Furniture More.

It also determines out how much of your repayments will go towards. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan.

Accumulated Depreciation Explained Bench Accounting

Amortization Vs Depreciation What S The Difference My Tax Hack

What Is Amortization Bdc Ca

Depreciation Nonprofit Accounting Basics

Furniture Depreciation Calculator Calculator Academy

/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

Are Depreciation And Amortization Included In Gross Profit

![]()

Furniture Calculator Splitwise

Depreciation Nonprofit Accounting Basics

Accounting Rate Of Return Formula Examples With Excel Template

Accounting Rate Of Return Formula Examples With Excel Template

How To Calculate Depreciation Expense For Business

Definition Of Amortization Schedule Chegg Com

How To Calculate Macrs Depreciation When Why

Furniture Fixtures And Equipment And Depreciation Kdp Llp

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate Formula Examples How To Calculate

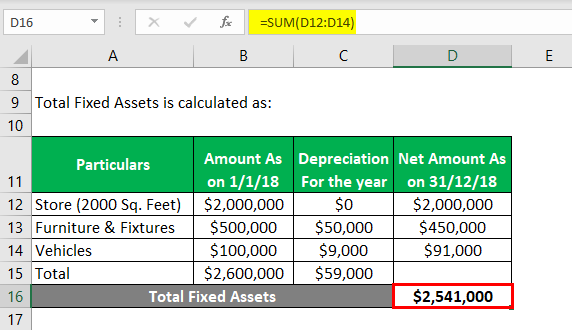

Fixed Asset Examples Examples Of Fixed Assets With Excel Template